Government Subsidy on Cold Storage Facilities for Milk and Milk Products

The Dairy Entrepreneurship Development Scheme (DEDS) is funded by NABARD to assist farmers in various ways, including a subsidy on setting up Cold Storage facilities for Milk & Milk Products. The prime focus is to uplift the dairy business in India and to assist farmers in generating secondary allied income.

Following are the objectives of the scheme:

- To promote setting up of modern dairy farms for production of clean milk

- To encourage heifer calf rearing thereby conserve good breeding stock.

- To bring structural changes in the unorganized sector so that initial processing of milk can be taken up at the village level itself.

- To bring about upgradation of quality and traditional technology to handle milk on a commercial scale.

- To generate self-employment and provide infrastructure mainly for unorganized.

Eligibility:

The scheme was designed in such a way that everyone should get equal opportunity to avail the benefits of the scheme and they are listed as follows;

- Farmers, individual entrepreneurs, NGOs, companies, groups of unorganised and organized sector etc. Groups of organized sector include self-help groups, dairy cooperative societies, milk unions, milk federations etc.

- An individual will be eligible to avail assistance for all the components under the scheme but only once for each component.

- More than one member of a family can be assisted under the scheme provided they set up separate units with separate infrastructure at different locations. The distance between the boundaries of two such farms should be at least 500m.

Unit Cost:

The maximum allowance of the financial loan Rs 30 lakh only.

Pattern of Assistance:

The farmer will get 25% of the outlay for general category and 33.33 % for SC / ST farmers as back ended capital subsidy subject to a ceiling of Rs 7.5 Lakh and Rs 10 Lakh for SC/ST farmers.

Funding Pattern:

- Entrepreneur contribution (margin) – 10 % of the outlay (minimum)

- Back ended capital subsidy – 25% of outlay for general category and 33.33% for SC/ST Category

- Effective Bank Loan – Balance portion, Minimum of 40% of the outlay

Linkage with Credit

Assistance under the scheme would be purely credit linked and subject to sanction of the project by eligible financial institutions.

Eligible Financial Institutions

- Commercial Banks

- Regional Rural Banks

- State Cooperative Banks

- State Cooperative Agriculture and Rural Development Banks: and

- Such other institutions, which are eligible for refinance from NABARD.

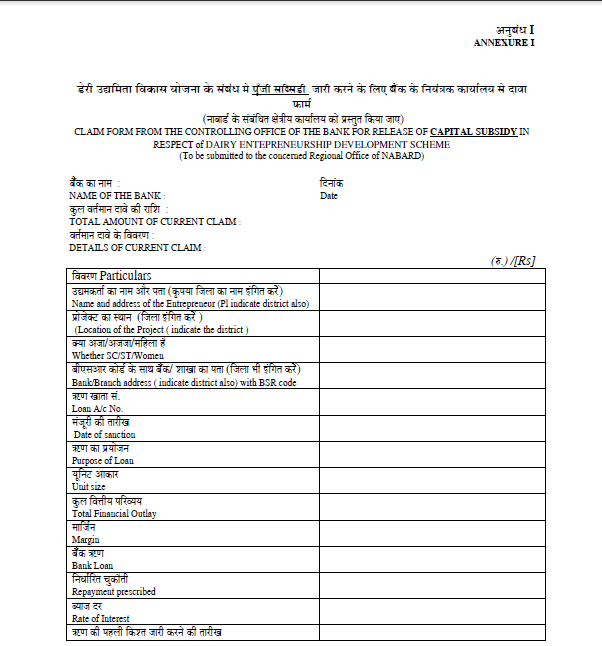

Application Forms / Format for Application:

Procedure to get NABARD Subsidy for Dairy Farming

The following are the steps to be followed for getting the NABARD Subsidy for Dairy Farming:

Step 1: Decide which type of business activity you are going to establish that pertains to dairy farming. The activity to be undertaken or business model can be one of the mentioned types above.

Step 2: Register a company or any other suitable business or NGO entity.

Step 3: Prepare a detailed project report or business plan for the dairy farm including a request for bank loan.

Step 4: Submit request for bank loan to any commercial bank or regional rural bank or state cooperative bank or state cooperative agriculture and rural development bank or other institutions, which are eligible for refinance from NABARD.

Step 5: Once the bank loan is sanctioned, the promoter would have to implement the project using his contribution and bank loan. Authority for sanction of the loan, interest rate, tenure and collateral requirement is left to the Bank.

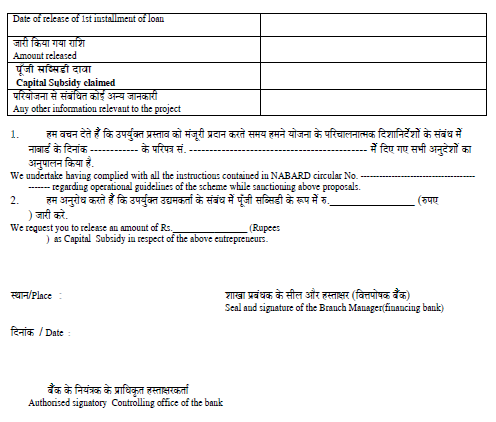

Step 6: On disbursement of first instalment of the loan, the Bank would have to apply to NABARD for sanction and release of NABARD subsidy for dairy farming.

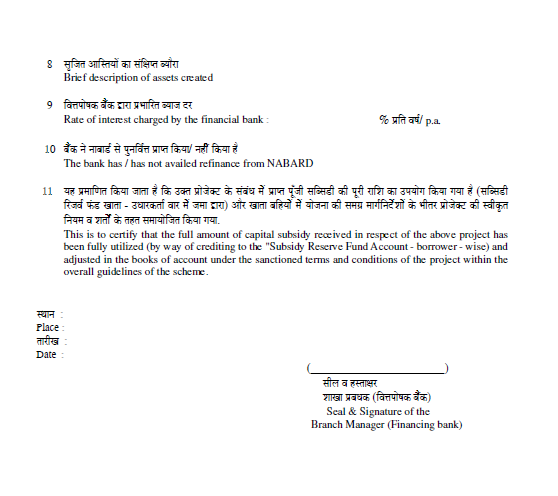

Step 7: NABARD would release the subsidy to the bank. The would hold the subsidy in an account classified as “Subsidy Reserve Fund Account” with no interest.

Step 8: On satisfactory servicing of the loan obligation by the promoter, the subsidy amount in the Subsidy Reserve Fund Account would be adjusted against the last few repayments of the bank loan.

Submitting Authority:

The proposal should be submitted to the Branch Manager of any eligible financial institutions listed above whichever is near and convenient.